All Categories

Featured

Table of Contents

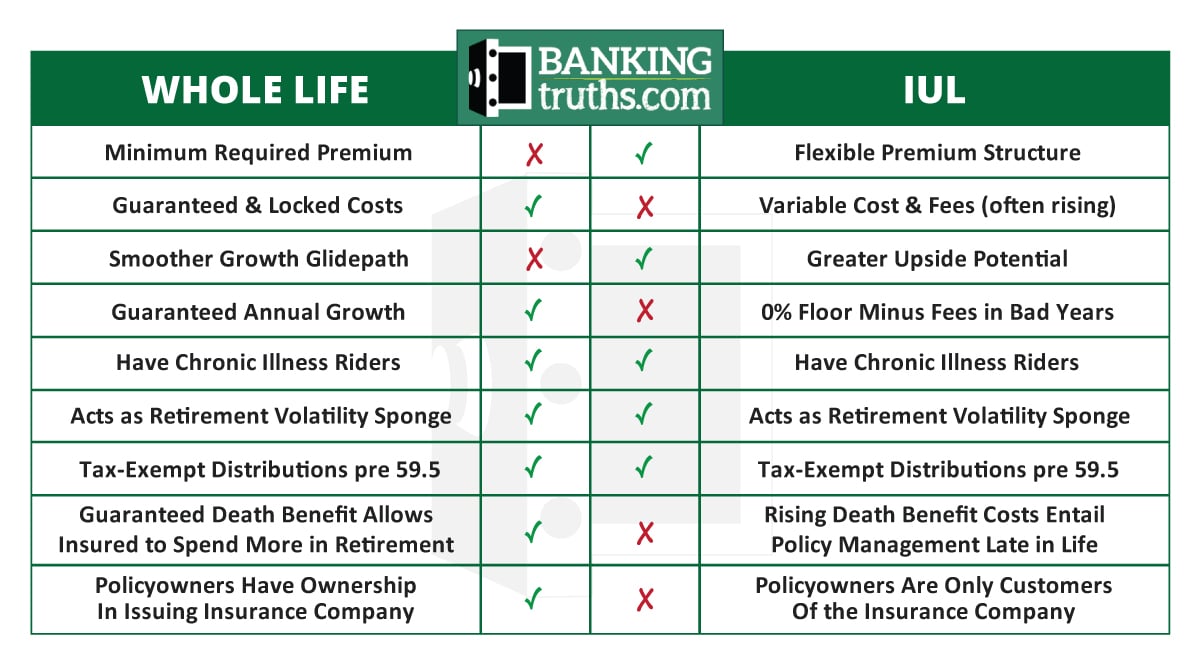

Indexed universal life policies offer a minimal surefire rates of interest, likewise referred to as a passion crediting flooring, which reduces market losses. As an example, say your cash worth loses 8%. IUL cash value. Lots of business give a flooring of 0%, suggesting you won't shed 8% of your investment in this situation. Be mindful that your money worth can decline despite a flooring as a result of costs and other prices.

It's additionally best for those ready to presume additional danger for higher returns. A IUL is an irreversible life insurance policy plan that borrows from the residential or commercial properties of an universal life insurance policy plan. Like universal life, it permits versatility in your death benefit and premium repayments. Unlike global life, your money value expands based upon the efficiency of market indexes such as the S&P 500 or Nasdaq.

What makes IUL different from other plans is that a section of the exceptional settlement goes into yearly renewable-term life insurance coverage. Term life insurance coverage, likewise recognized as pure life insurance coverage, warranties death advantage settlement.

An IUL plan may be the right selection for a customer if they are looking for a lifelong insurance item that constructs riches over the life insurance policy term. This is since it uses prospective for growth and additionally maintains one of the most value in an unsteady market. For those who have significant possessions or wealth in up-front financial investments, IUL insurance coverage will be a wonderful wide range administration tool, particularly if a person desires a tax-free retired life.

What types of Iul Insurance are available?

The rate of return on the policy's cash worth fluctuates with the index's activity. In comparison to other plans like variable global life insurance policy, it is much less risky. Urge clients to have a discussion with their insurance representative concerning the most effective option for their scenarios. When it concerns dealing with beneficiaries and handling riches, right here are some of the leading reasons that a person may choose to pick an IUL insurance plan: The cash money value that can accrue because of the rate of interest paid does not count toward incomes.

This implies a customer can utilize their insurance coverage payment rather than dipping into their social safety money prior to they are prepared to do so. Each policy ought to be tailored to the client's personal requirements, specifically if they are handling large properties. The insurance holder and the representative can choose the quantity of threat they think about to be proper for their needs.

IUL is a general conveniently adjustable plan. Because of the rate of interest of global life insurance policy plans, the rate of return that a client can potentially get is more than various other insurance policy coverage. This is because the owner and the agent can leverage call choices to enhance possible returns.

Who are the cheapest Iul Death Benefit providers?

Insurance policy holders might be brought in to an IUL policy due to the fact that they do not pay resources gains on the extra money worth of the insurance coverage. This can be contrasted to various other plans that call for tax obligations be paid on any type of money that is taken out. This means there's a cash possession that can be gotten at any kind of time, and the life insurance policyholder would not need to stress over paying taxes on the withdrawal.

While there are several advantages for a policyholder to select this kind of life insurance policy, it's except everyone. It is essential to allow the consumer know both sides of the coin. Below are several of the most important things to encourage a customer to take right into factor to consider prior to deciding for this option: There are caps on the returns an insurance holder can receive.

The most effective option relies on the client's risk resistance - IUL cash value. While the costs connected with an IUL insurance plan deserve it for some customers, it is essential to be upfront with them concerning the costs. There are superior expense fees and various other administrative costs that can begin to include up

No assured rate of interest rateSome other insurance coverage provide a rates of interest that is ensured. This is not the case for IUL insurance. This is fine for some, however for others, the unknown fluctuations can leave them feeling subjected and insecure. To learn more about managing indexed global life insurance policy and suggesting it for particular clients, reach out to Lewis & Ellis today.

Who are the cheapest Iul Growth Strategy providers?

It's crediting price is based on the efficiency of a stock index with a cap rate (i.e. 10%), a floor (i.e.

8 Permanent life insurance consists of two types: kinds life and universal lifeGlobal Cash value grows in a taking part whole life plan via rewards, which are proclaimed every year by the business's board of directors and are not assured. Money value expands in a global life policy via attributed rate of interest and lowered insurance expenses.

Is Flexible Premium Indexed Universal Life worth it?

Regardless of how well you prepare for the future, there are events in life, both expected and unexpected, that can influence the financial health of you and your liked ones. That's a factor permanently insurance coverage. Fatality advantage is normally income-tax-free to beneficiaries. The fatality advantage that's normally income-tax-free to your recipients can help ensure your family will have the ability to keep their criterion of living, aid them keep their home, or supplement shed earnings.

Things like potential tax boosts, inflation, financial emergencies, and intending for events like college, retirement, and even weddings. Some kinds of life insurance policy can aid with these and other concerns also, such as indexed universal life insurance coverage, or simply IUL. With IUL, your policy can be an economic source, because it has the potential to construct value over time.

An index might affect your interest attributed, you can not spend or straight get involved in an index. Here, your policy tracks, but is not actually spent in, an exterior market index like the S&P 500 Index.

Costs and expenses might reduce policy values. This rate of interest is secured. So if the marketplace goes down, you will not shed any rate of interest as a result of the drop. You can likewise choose to get set rate of interest, one set foreseeable rates of interest month after month, regardless of the marketplace. Since no single allocation will be most efficient in all market settings, your economic professional can aid you identify which combination may fit your economic objectives.

How can Iul Loan Options protect my family?

Since no solitary allotment executes ideal in all scenarios, your financial professionalcan aid you identify which mix might fit your monetary objectives. That leaves much more in your plan to possibly maintain growing over time - Indexed Universal Life companies. Down the road, you can access any type of readily available money value through policy financings or withdrawals. These are revenue tax-free and can be used for any type of objective you desire.

Latest Posts

Guaranteed Universal Life Insurance Definition

Iul Insurance Meaning

Insurance Index Funds